The primary value of a charity gift card is to connect with your employee / customer / prospect by giving them a gift card that they can use on the nonprofits they care about.

To facilitate that, the company lets the individual make the donation. Giving them a charity gift card, the company simply sets the total amount allotted for donations. They may even set specific rules, such as an expiration date, to help motivate an individual to give.

This offers a few benefits beyond the charitable gifting and giving:

- Budgeting. A digital gift card comes with a built-in advantage: you can set the limit. Like a credit card’s limit, there’s no going beyond the donation amount you decide upon beforehand. This means that while the individual can choose the nonprofit organizations they give to, they can’t go beyond this basic set limit.

- Flexibility. A list of pre-approved charities usually doesn’t go over very well. But a charitable gift card puts power in the hands of the individual. They can choose the charitable organizations they engage, which gives a high degree of customization to your outreach program.

From the company’s angle, using what is essentially a “gift certificate” like this can be a wise way to handle company outreach, improve employee engagement, and use a solution with plenty of flexibility. But is this a good gift when there are other options involved? Let’s look at what a charity gift card means for companies who want to give the gift of giving.

Charity Gift Cards: What You Need to Know

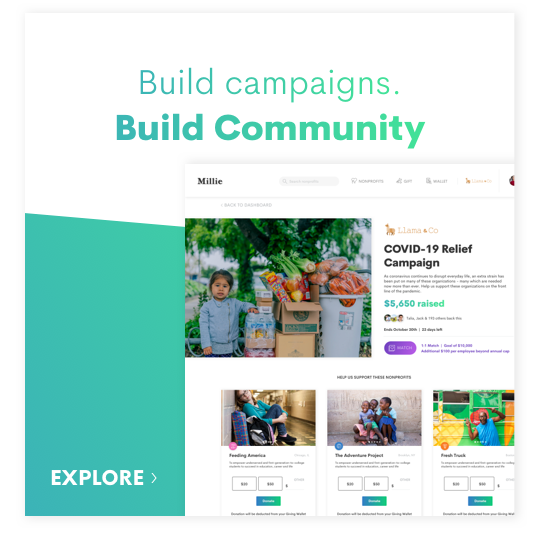

When some companies prepare to give employees “the gift of giving” around the holidays, for example, they often provide a list of charities. The charity gift card means that you don’t have to submit a list of charities for people to review. You can simply offer the gift card and consider your role complete. It’s now up for the employees to pick out which charities they want to receive the gift certificate.

How do charity gift cards work? Quite simply, you set the rules. On top of setting the budget for the charitable outreach, you can choose the type of charity gift cards, the issuers you’ll want to work with, the dollar amount, and expiration date.

When is it appropriate to use charity gift cards? There are plenty of situations in which companies can use it to boost employee morale:

- The holidays and work anniversaries. Gifting something like this to employees during the holidays can be a nice way to let them know you’re thinking about them. The same goes to giving a gift card for a work anniversary to an employee

- New initiatives. Let’s say you’re opening a new fundraising program, and want a way to get people into the “mode” of giving. Giving out charitable gift cards is a great way to inspire people to give.

Are Donated Gift Cards Tax Deductible?

Many of us are familiar with how valid charitable donations are completely tax deductible. And this is a great incentive for people to give. Not only do people like to give out of the goodness of their hearts, but it makes a nice sweetener to deduct these valid gifts come tax time.

If you want to be sure about your tax deduction status, you can always give cash gifts instead. This would likely require working through a platform like Millie.

Can a Gift Card be a Digital Card?

Yes. A charitable donation through a digital or egift card will work in the same way as gift card would work. The same principles are in place. In this case, the only difference is that the individual making the charitable donation–your employee–will go about donating to the charity of their choice in a different way.

This is great for employees because it cuts down on the use of both non-biodegradable and biodegradable plastic. It eliminates the question for the employers of which card designs to choose from. And since so many of us shop with our “digital” wallets these days rather than our physical ones, it will likely become the way people give in the future, as well.

Why is a Gift Card a Great Idea for Customers and Prospects?

Main reason other than making them feel good is some companies have strict guidelines around what they can receive from vendors with no gift policies and this doesn’t apply since they don’t accept anything it’s just allocation

Why is a Gift Card a Great Idea for Employees?

Employees often want to feel like they have some say in things. By giving them a charity gift card, you put them in the driver’s seat. You’re still the one making the financial commitment. You’re still the one setting the budget. But for employees, it’s usually a fun experiment to look through a list of viable, reputable charities and select one that aligns with their true innermost values.

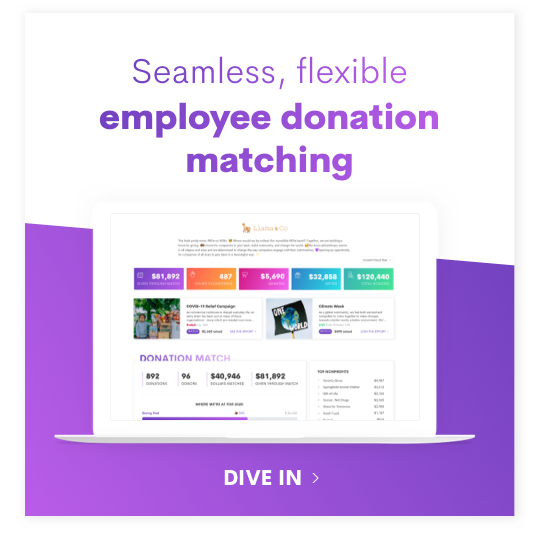

Holiday season or not, a gift card can change peoples’ moods. As the employer, you’ll also complicate things less because you’ll be out of it at that point. And since gift cards provide more options, you won’t have to worry about selecting the “right” charity. It eliminates a lot of the pain, frustration, and guesswork that comes from launching your first charitable donation outreach program. And when you use this gift card as a way to initiate employees into your company and understand your commitment to outreach, you can think of it as a “foot in the door” for launching volunteer programs, employee donation matching programs, and more.